Secure Additional Income Streams, Build Capital & set yourself up for Retirement through Strategic Property Investments

You are the sum of the 5 people you surround yourself with

Join our community each week as we discuss real life learnings & opportunities to move you forward. From overcoming hurdles to massive wins - Share with your community for advanced support.

~ Strategic Property networking ~

What the Community Provides you

The Community is guided by two seasoned veterans in the property space with 40+ years of experience between them

Experience & Education

Each week we connect on an Ask Me Anything (AMA) call and look at challenges we are all facing by way of comments in our community forum, as well as any live deals that we can all share in.

Weekly Accountability

Stay on track with your goals through consistent check-ins, real-time feedback, and a supportive group that actually shows up. Our weekly calls keep you focused, fired up, and moving forward — no more going it alone.

If you want to go far, go with a team

Early Access to Investment Deals

As part of our community, you'll be the first to hear about new property investment opportunities from our sister company, ZA Homes — before they go public.

Our Community ALSO Gives Full Access

To All Our Courses

Maximize multiple streams of Income and Retirement Wealth with Strategic Property Education

Gaining Traction In Property Investing

We offer this tailored course to get you started with the fundamentals.

This step-by-step Property Investing course is for people who want to grow their property portfolio & generate significant income.

Learn how to :

✅ 1. quickly set and achieve investing goals that fits your lifestyle, income, and global ambitions.

✅ 2. Build Your Global Power Team 🌍

✅ 3. Align Your S.A.P — Strategy, Area, Property.

✅ 4. Run the Numbers Like a Pro 💰

Use our proven template to analyze deals — fast and Avoid hidden costs that trap most amateur investors.

✅ 5. Structures & Entities to

Protect your assets and optimize your taxes

✅ 6. Create Big Deals with Little (or No) Money - Learn how to partner, co-invest, or raise capital

Advanced Investors Course

Ready to take your investing to the next level?

This course is built for investors who want to move beyond the basics and start playing the game at a professional level. Whether you're scaling a portfolio or structuring smarter deals, this is where strategy meets execution.

Inside, you'll learn how to:

✅ Structure multilet investments for maximum cashflow

✅ Leverage instalment sale agreements to secure deals with little to no money upfront

✅ Navigate legal contracts like a pro — with practical breakdowns you’ll actually use

✅ Finance deals creatively using partnerships, seller finance & more

✅ Set up the right structures (companies, trusts, etc.) to protect your wealth and minimize tax

This isn’t theory — it’s the advanced playbook Michael and the team have used to build serious wealth in property. If you're ready to unlock high-level property strategies and bulletproof your investment future, this course is for you.

Airbnb Superhost: From A to Z Course

This step-by-step Airbnb course is for anyone who wants to optimize, automate, and scale — without losing control or their Superhost badge.

Learn how to:

✅ 1. Create a 5-star guest experience using video workflows that eliminate confusion and repetitive messaging

✅ 2. Set up automated communication templates that actually save you time

✅ 3. Optimize your listing title, images & amenities to increase clicks and bookings

✅ 4. Unlock repeat bookings using simple remarketing and referral systems

✅ 5. Find & negotiate with landlords who say yes to Airbnb — and scale without buying property

✅ 6. Set up a co-hosting model and scale to 20+ units using VAs and agents

✅ 7. Build a business that runs on SOPs, not stress

Testimonials

Jasmine R

"I implemented Jacques’ video workflows and automated 90% of my messaging in a week. Game changer. I now spend less time online and get more 5-star reviews than ever before."

Monica C

"The community support is worth the price alone. Weekly calls helped me get my listings optimized and gave me the accountability I needed to stay consistent. Everyone’s in the trenches — no egos, just real help."

Thomas K

"The Gaining Traction course gave me the clarity I needed to get started. I finally understood how to run the numbers, pick the right area, and structure deals that actually make sense. So valuable if you’re new to property."

Your Community Guides

The Community is guided by two very experience property Investors

Michael Bowen

“Michael’s a seasoned property investment expert, a property professional brilliant at cash-flow-positive real estate investing, an energizing businessman, and inspirational speaker and coach.”

Ronel Jooste from

Financially fit Life

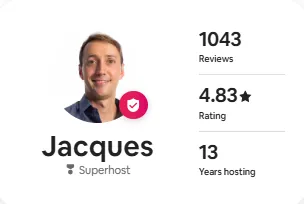

Jacques du Toit

Jacques is a seasoned Entrepreneur & Airbnb Superhost since Dec 2012 and has his own units and manages a sizeable client portfolio.

FAQs

Your Questions Answered: Insightful Property Investment Guidance for Retirement

What makes Retire On Property different from others?

We offer real-world, battle-tested experience across multiple property investment strategies — from multi-lets to instalment sales and creative financing. Unlike most platforms, you get direct access to us every week on live calls, plus full access to all our property courses and tools, all bundled into one simple, low monthly subscription. No upsells, no fluff — just the support and systems you actually need to succeed.

Can I start investing in properties if I'm already close to retirement?

Absolutely. Its never too late to start investing in properties. We customize investment strategies based on your current financial situation and retirement timeline to maximize your returns in a shorter period.

Are properties the only investment option you recommend?

While our primary focus is on property investment, we consider it a part of a diversified retirement portfolio. Depending on individual needs, we may also recommend other investment types to balance and optimize returns.

How can I assess the risk involved in property investment through your services?

Our courses and guidance include proven frameworks, practical tools, and custom-built calculators that help you assess risk accurately and confidently. We equip you to evaluate deal viability, analyze market trends, and stress test each investment — so you can make data-driven decisions and avoid costly mistakes.

What kind of properties do you recommend investing in for cashflow, retirement, or capital?

We recommend properties with stable rental yields and potential for appreciation such as residential properties in prime locations or multi-unit residential buildings.

How do you charge for your services?

We operate on a subscription based structure of $40 per Month, which you can cancel at any time.